The health insurance industry is undergoing rapid change.

This requires understanding the advantages of the domain and the technology stack driving the transformation for insurers.

The modern healthcare industry, or digital health ecosystem as it is more commonly known, is designed to elevate patients.

Every player in the medical business and process have been working together to maintain patients at the core of the healthcare transformation ecosystem.

Although insurers: The third important player in the healthcare sector—are naturally adopting this patient-first system, they are finding the change to be rather difficult.

This article will examine the capabilities that payers must limit in order to thrive in the increasingly competitive world of digital health insurance.

The insurance sector is facing a cultural change that will prioritise the welfare of individuals.

The change has compelled the industry to transition from providing monetary compensation for harm, illness, or loss to focusing on reducing or preventing them.

Every bespoke healthcare software development company's usage of technology has been crucial in bringing about this shift in health insurance digital transformation.

In this article, we'll explore the technology that insurance companies might use to compete in the world of digital health services.

Let's first examine the advantages that would make the domain a contributor to the evolving scene of healthcare digital transformation.

The Advantages of a Digital Insurance Industry

- Digital solutions assist customers in making wise choices

People can avoid diseases, improve diagnoses, manage chronic ailments, and reduce lifestyle risks with the aid of wearable technology and insurance-friendly apps.

Many modern consumers anticipate getting digital wellness solutions from their health and care providers and insurance.

By providing customer-focused programmes like health quantification, etc., new-generation insurers can satisfy this consumer demand.

- Digital platforms facilitate interaction between users and insurers

With the help of digital tools and platforms, insurers may offer their customers a warm, engaging environment on which they can implement a "I care" campaign.

The platforms serve as a way to communicate with customers in a pleasant way, but they also collect data that can be used to improve procedures and values.

- Insurance costs and risk are reduced by digitization

The total health of users is portrayed in depth by digital healthcare services.

Based on the data, the insurers can develop a strategy for using dynamic pricing to tailor premiums.

The data-driven methodology also makes it possible to estimate risk, which facilitates expedited underwriting.

Insurers can adopt a more value-driven care model by using data-driven evaluation.

- Insurance industry digitalization improves client experience

Through more touchpoints and innovative offerings, the digital environment aids healthcare insurance service providers in optimising the client experience.

Here are some examples of how it is used:

- Personal health management through digital health insurance

- Virtual delivery of healthcare

- Solutions for connected cars and smart homes

- Voice technology for customer advice.

- Data domination may be secured through digital means

Data production in the insurance industry is at an all-time high.

Big data ecosystems have been developed and scaled in order to provide visible data sets that may offer benefit plans based on success metrics.

Big data-savvy providers and healthcare app creators are able to create individualised client experiences, improve retention, and generate more accurate quotations much more quickly than with conventional methods.

The adoption of a new-gen technology set is necessary to reap these advantages as well as a host of others.

Health insurance technology has evolved into a force that can propel the industry toward end-to-end digitalization.

Technologies Supporting Digital Insurance

As they handle claims, insurers compile a sizable quantity of information from many sources.

Healthcare mobility solutions and the integration of machine learning into the workflow may be used to create customer relationship management systems that provide focused service and reduce turnover.

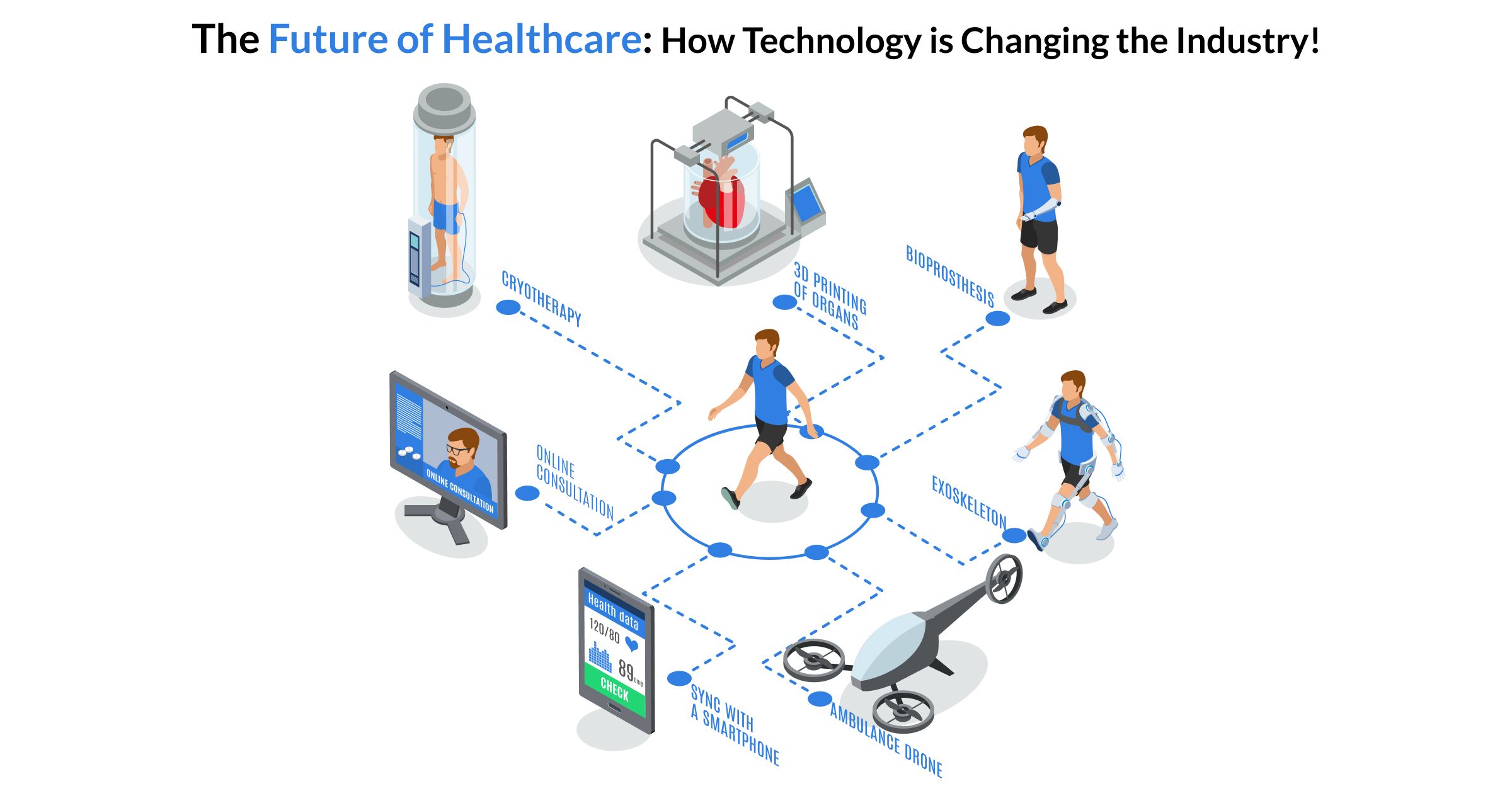

The business is also looking into methods to leverage technology to assist doctors in providing patients with proactive, efficient, and affordable care.

The healthcare sector is no longer uncertain about the potential of wearable technology because there are now over 1 billion active wearable devices on the market.

The biosensors included into wearables are becoming increasingly advanced to function as linkages in the digitised healthcare system, which prioritises treatments done at home.

Insurance firms can alert concerned clients to trouble indicators before they become diseases thanks to the data acquired by the sensors.

When a patient engages with the healthcare system, they communicate with a variety of people, including physicians, pharmacists, insurance providers, etc.

With everyone on the same platform thanks to a distributed ledger, conversations, transmissions, and transactions may all be visible and real-time.

Patients no longer have to wait for insurance companies to release payment since they are informed of their stage in the healthcare system, which serves as an example of this.

Data is one of the most important resources in the healthcare industry, and as a result, insurers are at the centre of the provider side of the digitalization landscape.

While many healthcare providers are still waiting for the digitalization switch to turn on, a number of insurance firms are using data to actively participate in the transformation of the industry.

Whatever the situation may be on the insurer's end, the flip side of the story is that members are appreciating insurers' efforts at digitization by using value-added services more frequently.

It implies that the best moment to enter the market is right now for an insurance firm.

You can rely on us.

Our team can assist you in developing an infrastructure that will enable you to attract clients to a platform that is transparent and offers added value.

Reach out to our team of digitization specialists in the insurance sector.