Introduction

The world of finance has seen some of the most significant technological changes and advancements over the last decade. One of the most exciting innovations to emerge is blockchain technology.

The world of finance has seen some of the most significant technological changes and advancements over the last decade. One of the most exciting innovations to emerge is blockchain technology.

Blockchain technology is a decentralized and distributed digital ledger that records transactions on multiple computers securely and transparently. It has already started to transform the way we do business, and it's only going to get more popular. In this blog post, we will explore the rise of blockchain technology in fintech and its impact on the industry.

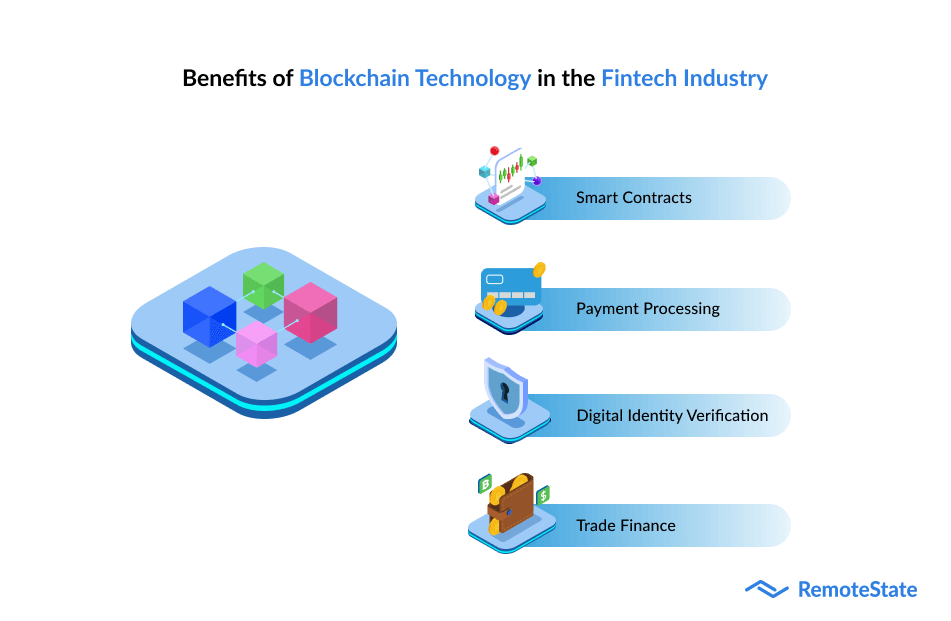

Benefits of Blockchain Technology in the Fintech Industry

Blockchain technology is making a significant impact on the financial industry. It offers several benefits, including increased security, transparency, and efficiency. The use of blockchain technology in fintech can be broken down into four main areas:

Payment Processing

Blockchain technology offers a faster, cheaper, and more secure way to process payments. Blockchain-based payment systems eliminate the need for intermediaries such as banks or payment processors, reducing costs and increasing transaction speed. This technology also provides users with complete control over their funds, reducing the risk of fraud or theft.

Digital Identity Verification

Blockchain technology can be used to create secure and tamper-proof digital identities. This can help prevent identity theft and fraud in the financial industry. Blockchain-based identity verification systems can provide secure and reliable authentication for financial transactions, eliminating the need for traditional methods such as passwords or PINs.

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. They are computer programs that automatically execute the terms of a contract when certain conditions are met. Smart contracts can reduce the need for intermediaries, increasing efficiency and reducing costs.

Trade Finance

Blockchain technology can be used to improve the trade finance process. It can reduce the risk of fraud and increase efficiency by providing a secure and transparent ledger of transactions. Blockchain-based trade finance systems can also eliminate the need for intermediaries, reducing costs and increasing speed.

Impact of blockchain technology on the financial industry

Blockchain technology is having a significant impact on the financial industry. It is enabling new business models, reduces costs, and increasing efficiency. Here are some of the main ways blockchain technology is changing the financial industry:

Reduced Costs

Blockchain technology is reducing the costs associated with financial transactions. By eliminating intermediaries, such as banks or payment processors, blockchain-based systems can reduce transaction fees and other costs. This can help make financial transactions more accessible to everyone, regardless of their location or financial status.

Increased Security

Blockchain technology offers increased security for financial transactions. By using a decentralized and distributed ledger, blockchain-based systems can prevent fraud and other types of cybercrime. This can help protect consumers and businesses from financial losses and other risks.

Improved Transparency

Blockchain technology provides increased transparency for financial transactions. By creating a secure and tamper-proof ledger of transactions, blockchain-based systems can provide complete visibility into the entire financial transaction process. This can help increase trust and confidence in the financial system, making it more attractive to investors and businesses.

Greater Efficiency

Blockchain technology can help increase efficiency in the financial industry. By reducing the need for intermediaries and providing secure and transparent ledger systems, blockchain-based systems can streamline financial transactions and reduce the time and cost associated with them. This can help businesses become more competitive and improve their bottom line.

Challenges of Blockchain Technology in the Fintech Industry

While blockchain technology offers many benefits to the financial industry, some challenges need to be addressed. Here are some of the main challenges of blockchain technology in fintech:

Scalability

One of the biggest challenges of blockchain technology in fintech is scalability. Current blockchain technology is limited in its ability to handle large-scale transactions. As the number of transactions increases, the blockchain network can become slow and congested. This can cause delays and increase transaction costs, making it difficult for blockchain-based systems to compete with traditional financial systems.

Regulatory Challenges

The financial industry is heavily regulated, and blockchain technology can present regulatory challenges. There are concerns about data privacy, compliance, and accountability. Regulators need to find a way to balance the benefits of blockchain technology with the need for regulatory oversight.

Interoperability

Blockchain technology is still in its early stages, and there are many different blockchain platforms and protocols. This can make it difficult for different systems to communicate with each other, creating interoperability issues. Interoperability is essential for blockchain-based systems to reach their full potential, and industry standards must be established to address this challenge.

Security

While blockchain technology offers increased security, it is not immune to cyber threats. There have been several high-profile security breaches in the blockchain industry, highlighting the need for stronger security measures. As the use of blockchain technology increases, the security of the network must be continually improved to prevent attacks.

Conclusion

Blockchain technology has the potential to revolutionize the financial industry. It offers increased security, transparency, and efficiency, and it's already being used in areas such as payment processing, digital identity verification, smart contracts, and trade finance.

However, several challenges need to be addressed, including scalability, regulatory challenges, interoperability, and security. As the use of blockchain technology in fintech continues to grow, it will be essential to address these challenges and find ways to harness the full potential of this innovative technology.

How Remotestate can help your business harness its full potential

Remotestate can help businesses navigate the opportunities and challenges of blockchain technology in fintech. We have a team of experts in blockchain technology, finance, and compliance who can provide customized solutions to meet your business needs.

Our services include

Blockchain development

We can help you develop and implement blockchain-based solutions for payment processing, digital identity verification, smart contracts, and trade finance.

Compliance and regulatory advisory

We can guide compliance and regulatory issues related to blockchain technology in fintech, helping you to navigate the complex legal landscape.

Interoperability solutions

We can help you address the interoperability challenge by developing customized solutions that enable different blockchain systems to communicate with each other.

Security solutions

We can help you implement robust security measures to protect your blockchain-based systems from cyber threats.

At Remotestate, we understand the potential of blockchain technology in fintech, and we are committed to helping our clients unlock their full potential. Whether you are a startup or an established business, we can help you navigate the challenges and opportunities of blockchain technology in fintech.

In conclusion, the rise of blockchain technology in fintech presents a significant opportunity for businesses to increase security, transparency, and efficiency while reducing costs. However, it also presents several challenges, including scalability, regulatory issues, interoperability, and security.

With the help of Remotestate, businesses can harness the full potential of blockchain technology in fintech and stay ahead of the curve in the rapidly evolving financial landscape.

FAQ's

What is blockchain technology?

Blockchain technology is a decentralized and distributed digital ledger that records transactions on multiple computers securely and transparently.

How is blockchain technology being used in fintech?

Blockchain technology is being used in fintech in areas such as payment processing, digital identity verification, smart contracts, and trade finance.

What are the benefits of using blockchain technology in fintech?

The benefits of using blockchain technology in fintech include increased security, transparency, efficiency, and reduced costs.

What are the challenges of using blockchain technology in fintech?

The challenges of using blockchain technology in fintech include scalability, regulatory challenges, interoperability, and security.

What is the impact of blockchain technology on the financial industry?

The impact of blockchain technology on the financial industry includes reduced costs, increased security, improved transparency, and greater efficiency. It is also enabling new business models and changing the way financial transactions are conducted

Publication Date

2023-03-21

Category

Fintech

Author Name

Sajal Nehra