Introduction

Machine learning is the driving force behind the digital transformation that is taking place in the financial services industry. Systems are given the capacity to automatically learn from experience and get better over time.

Machine learning is the driving force behind the digital transformation that is taking place in the financial services industry. Systems are given the capacity to automatically learn from experience and get better over time.

With billions of crucial transactions taking place every second and a load of personal data being handled, the finance industry is particularly prone to fraud. Scammers are constantly trying to break into servers to steal important information for extortion.

Money laundering, insurance claims, electronic payments, and bank transactions are all areas where fraud is detected and prevented.

The key applications of machine learning in finance for fraud detection will be discussed in this blog. Continue reading!

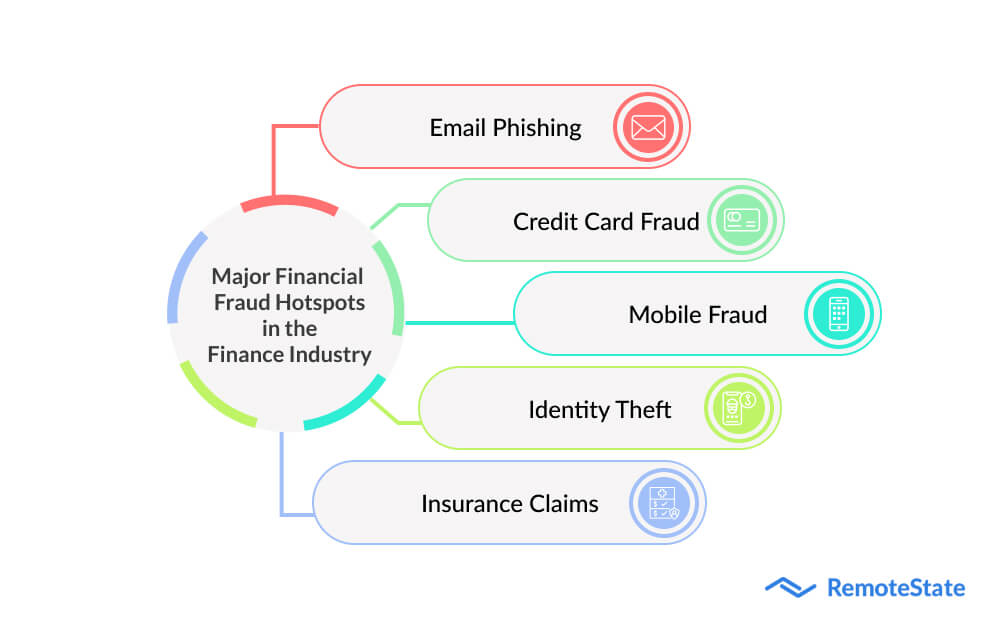

Major financial fraud hotspots in the finance industry

Let's discuss the various ways that financial fraud detection software can help businesses before delving into the specifics of machine learning in the financial sector.

Email phishing

This sort of cybercrime involves attackers sending victims phony emails with links to malicious websites. Since these emails appear to be genuine and legitimate, anyone could take them for granted and enter the sensitive information that puts them at risk.

You can utilize automated approaches for phishing detection using machine learning to stay away from such circumstances. These techniques are based on traditional classification and regression machine learning algorithms.

Credit card fraud

Credit card fraud has increased in frequency in our increasingly digital environment. Through unsecured internet connections, one kind of financial theft involves stealing debit or credit card details.

Algorithms for machine learning assist in distinguishing between legitimate and prohibited behavior. An ML model can notify the bank of attempts to trick the system so that action can be taken to stop the activity.

Mobile fraud

When payment methods move beyond physical cards and into the world of mobile phones, machine learning integration in anti-fraud systems is very important.

With the inclusion of NFC chips in smartphones, consumers may now make mobile payments for goods. As a result, your smartphone is vulnerable to hacking and other online dangers. Machine learning in finance is a useful technique for identifying unusual user behavior and reducing the risk of mobile fraud.

Identity theft

The risk of a cybercriminal accessing information such as a user's name, bank account information, passwords, login credentials, and other extremely sensitive information is high. Businesses and individuals are equally in danger from identity theft.

To ensure that all instances of fraud are caught, machine learning in finance helps examine and compare identity documents like passports or licenses against safe databases in real-time. Additionally, ML can be used to combat false IDs by enabling face recognition and biometric scanning.

Insurance claims

False insurance claims frequently involve false descriptions of property damage, car damage, and even unemployment. Insurance firms invest a lot of effort and money into verifying each claim to decrease these frauds. However, this procedure is pricey and vulnerable to hacking.

Machine learning's outstanding pattern recognition abilities enable it to discover false claims and resolve insurance claims with maximum precision.

Why should machine learning be used to avoid fraud?

The finance and banking industries regard machine learning to be particularly beneficial in financial fraud detection. The application of sophisticated machine learning algorithms is ideal due to the large volume of transactional and customer data. Real-time fraud detection and flagging are made possible by machine learning in banks and other financial organizations.

Financial institutions experience a considerable decrease in the number of false positives (transactions that are mistakenly labeled as denied and fraudulent) and false negatives because of the improved accuracy of machine learning algorithms (where genuine instances of fraud are missed). This is the reason ML has assumed the top position in the finance industry.

If you're still unsure about how machine learning might assist your financial services company in identifying fraud, have a look at the list of advantages below.

Faster data collection

It's critical to have quicker solutions, like machine learning, to detect fraud as the speed of commerce rises. Massive amounts of data may be evaluated quickly using machine learning algorithms. They can continuously gather data, evaluate it in real time, and quickly identify fraud.

Simple scaling

As the size of the data set grows, machine learning models and algorithms improve. More data helps the machine learn better since it can distinguish between various behaviors' similarities and differences.

After distinguishing between legitimate and fraudulent transactions, the system can sort through them and start identifying those that belong in a certain bucket.

Efficiency gains

Unlike people, machines can carry out repetitive operations and identify changes across massive amounts of data. This is essential for fraud detection in a lot less time.

Thousands of payments can be precisely analyzed by algorithms every second. This improves process efficiency by cutting expenses and the amount of time needed to examine transactions.

Fewer instances of security breaches

Financial institutions may fight fraud and give their consumers the best level of protection by implementing machine learning technologies. Every new transaction is compared to the previous one, which includes personal information, data, IP addresses, locations, etc., to identify suspicious circumstances. Financial departments can avoid fraud involving credit or payment cards as a result.

Let's explore the machine learning models used for fraud detection now that we have seen the advantages of adopting this technology.

Models and techniques for detecting fraud using machine learning

The sorts of machine learning models and algorithms used in the financial sector to find financial fraud are listed below. Let's examine each of them individually now.

Supervised learning

In deep learning contexts in FinTech, supervised learning is effective in situations like fraud detection. All information must be classified as either positive or evil under this model. And it is founded on the examination of predicted data.

Unsupervised learning

When there is little or no transaction data available, an unsupervised learning model can be used to identify unusual activity. It continuously analyses and analyses fresh data, and updates its models in light of the results. Over time, it discovers the patterns and determines if the processes are honest or dishonest.

Semi-supervised learning

It’s useful when labeling data would be difficult or expensive and would require human participation.

Reinforcement learning

This paradigm enables computers to automatically identify desirable behavior inside a given scenario. It enables machines to learn from their surroundings and discover precautionary measures.

How does an (ML) system work for fraud detection?

Data is first collected and segmented to begin the fraud detection process. The machine learning model is then loaded with training algorithms to forecast the likelihood of fraud.

The stages that demonstrate how an ML system functions for fraud detection are listed below:

Data input

Before the machine learning system can detect fraud, it must first gather data. An ML model's ability to learn and improve its fraud detection abilities improves the more data it receives.

Extraction of features

At this stage, elements are introduced that describe both honest and dishonest consumer actions. These qualities typically consist of:

-

Identity: It comprises the fraud rate of customers’ IP addresses, the age of their account, the number of devices they were seen on, etc.

-

Order: This feature shows the number of orders customers made, average order value, number of failed transactions, and more.

-

Location: This feature helps to find out if the shipping address matches the billing address if the shipping country matches the country of the customer’s IP address, and the fraud rate at the customer’s location.

-

Payment methods: It helps to identify the fraud rates in credit/debit card issuing banks, the similarity between customer name and billing name, etc.

-

Network: It includes the number of emails, phone numbers, or payment methods shared within a network.

Train algorithm

To determine whether an operation is fraudulent or valid, an ML model must follow a set of rules known as an algorithm. The ML model will perform better the more data your company can contribute to a training set.

Develop a model

Following the training, your business will obtain a machine-learning fraud detection model. This model can accurately and quickly identify fraud. However, a machine learning model needs to be updated and refined frequently to be effective at fraud detection.

Final thoughts!

Machine learning is now being used by businesses all around the world to stop financial fraud. It is the most cutting-edge technology available for preventing fraud, which causes bigger losses every year.

The financial services sector has made employing machine learning development services a top priority as a result. Our professionals at Remotestate equip diverse businesses with cutting-edge solutions and strategies to boost production and lower financial risk.

Get in touch with us if you wish to integrate machine learning systems or financial fraud detection technologies into your company. We'll assist you in understanding the enormous advantages of this ground-breaking technology and in growing your company at a lower expense.

Publication Date

2023-02-14

Category

Fintech

Author Name

Sajal Nehra