Introduction

The integration of Artificial Intelligence (AI) in the fintech industry has brought about significant changes in the way financial institutions operate. From personalized customer service to fraud detection and investment management, AI is revolutionizing the way financial services are delivered to customers.

The integration of Artificial Intelligence (AI) in the fintech industry has brought about significant changes in the way financial institutions operate. From personalized customer service to fraud detection and investment management, AI is revolutionizing the way financial services are delivered to customers.

In this blog, we will explore the role of AI in fintech, the challenges it poses, and the opportunities it presents.

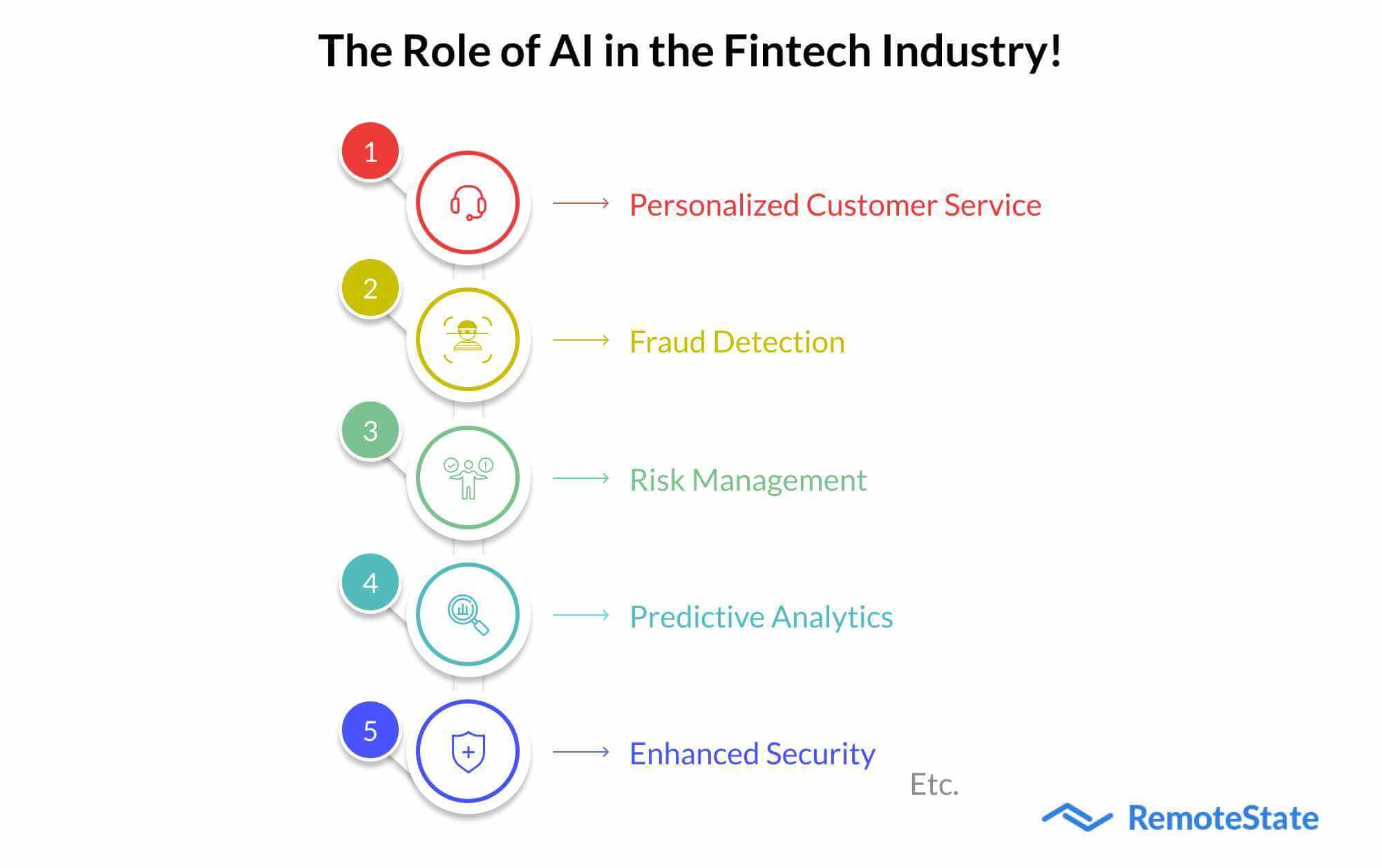

The Role of AI in the Fintech Industry!

AI is transforming the fintech industry by enabling financial institutions to automate processes, provide personalized services, and make better decisions.

Here are ten ways in which AI is revolutionizing fintech:

Personalized Customer Service

AI-powered chatbots provide 24/7 customer service that can handle queries, provide account information, and offer personalized recommendations based on customer preferences and history.

Fraud Detection

AI algorithms can detect fraudulent activities by analyzing large volumes of data and identifying patterns that may indicate fraudulent behavior. This enables financial institutions to prevent fraud and protect their customers' accounts.

Risk Management

AI can help financial institutions assess the creditworthiness of borrowers and manage risks by analyzing large amounts of data from various sources, such as credit scores, income, and spending habits.

Investment Management

AI algorithms can analyze financial data to provide personalized investment advice to customers based on their risk tolerance and investment goals. This can lead to better investment decisions and improved returns for customers.

Compliance

Financial institutions can use AI to ensure compliance with regulatory requirements by automating compliance checks and monitoring for suspicious activities. This helps to prevent financial crimes such as money laundering and terrorism financing.

Predictive Analytics

AI algorithms can analyze customer data to predict their future behavior and provide insights that enable financial institutions to make better decisions. This can include predicting customer churn, identifying cross-selling opportunities, and predicting market trends.

Improved Efficiency

AI can automate manual processes, leading to increased efficiency and cost savings. This can include automating loan approvals, insurance claims processing, and account opening processes.

Enhanced Security

AI can be used to identify security threats and prevent cyber-attacks. For example, AI can be used to detect and prevent phishing attacks or to identify fraudulent transactions.

Better Decision-Making

AI can analyze large amounts of data and provide insights that enable financial institutions to make better decisions. This can include identifying profitable investment opportunities, optimizing pricing strategies, and predicting market trends.

Increased Customer Satisfaction

Personalized services, automated processes, and 24/7 customer service can lead to increased customer satisfaction. This can help financial institutions to retain customers and attract new ones.

Challenges and Opportunities

While AI has tremendous potential to transform the fintech industry, it also poses some challenges. Here are ten challenges and opportunities associated with the use of AI in fintech:

Challenges

Data Privacy

One of the primary concerns with the use of AI in fintech is data privacy. Financial institutions collect large amounts of sensitive customer data, and the use of AI systems to analyze and process this data can pose a risk to customer privacy.

Bias and Discrimination

AI systems are only as unbiased as the data they are trained on. If the data used to train an AI system is biased, the system will perpetuate that bias in its decision-making. This can lead to discrimination against certain groups of customers.

Lack of Transparency

AI systems can be complex and difficult to understand, making it challenging for financial institutions to explain their decisions to customers. This lack of transparency can erode customer trust and confidence in the financial institution.

Human Oversight

While AI systems can automate many processes, they still require human oversight to ensure they are working as intended. Financial institutions need to invest in skilled personnel to monitor and maintain their AI systems.

Integration

Integrating AI systems into existing fintech infrastructure can be challenging and require significant resources. Financial institutions need to plan and budget accordingly to successfully integrate AI into their operations.

Regulatory Compliance

The use of AI in fintech is subject to regulatory compliance. Financial institutions need to ensure that they comply with regulations such as the General Data Protection Regulation (GDPR) and the Consumer Financial Protection Bureau (CFPB).

Technical Complexity

The development and implementation of AI systems can be technically complex, requiring specialized skills and expertise.

Reliance on Data

The accuracy and reliability of AI systems depend on the quality and quantity of data used to train them. Financial institutions need to ensure that they have access to sufficient and relevant data to train their AI systems.

Competition

As the use of AI in fintech becomes more prevalent, competition among financial institutions will increase. Financial institutions need to differentiate themselves by offering unique services and products that leverage AI.

Ethical Concerns

The use of AI in fintech raises ethical concerns such as the impact of automation on employment, the use of customer data, and the potential for AI to perpetuate biases and discrimination.

Opportunities

Improved Efficiency

One of the most significant benefits of AI in fintech is improved efficiency. AI can automate manual processes, leading to increased efficiency and cost savings. This can help financial institutions operate more efficiently and effectively, providing a better experience for customers.

Enhanced Customer Service

AI-powered chatbots can provide 24/7 customer service, enabling financial institutions to provide personalized service and improve customer satisfaction. This can lead to increased customer loyalty and retention.

Better Decision-Making

AI can provide insights that enable financial institutions to make better decisions, such as identifying profitable investment opportunities and predicting market trends. This can lead to increased profits and competitive advantage.

Enhanced Security

AI can be used to identify security threats and prevent cyber-attacks, helping to protect customers' accounts and sensitive data. This can help financial institutions build trust with their customers.

Personalization

AI can provide personalized services and recommendations based on customer preferences and history, leading to increased customer satisfaction and loyalty. This can help financial institutions retain customers and attract new ones.

Risk Management

AI can help financial institutions manage risks by analyzing large amounts of data and assessing the creditworthiness of borrowers. This can help financial institutions make more informed lending decisions and reduce the risk of default.

Compliance

AI can help financial institutions comply with regulatory requirements by automating compliance checks and monitoring for suspicious activities. This can help financial institutions avoid penalties and legal issues.

Innovation

AI can enable financial institutions to develop new and innovative products and services that leverage the latest technology. This can help financial institutions stay ahead of the competition

Cost Savings

By automating processes and improving efficiency, AI can help financial institutions save costs in areas such as customer service, fraud detection, and risk management.

Scalability

AI-powered systems can scale up or down quickly based on demand, making it easier for financial institutions to respond to changing market conditions and customer needs.

Competitive Advantage

By leveraging AI, financial institutions can differentiate themselves in the marketplace and gain a competitive advantage. This can help them attract new customers and retain existing ones.

Improved Accuracy

AI can help financial institutions make more accurate and reliable predictions, such as forecasting loan defaults or detecting fraudulent activities. This can lead to better risk management and improved profitability.

Faster Decision-Making

AI can process vast amounts of data quickly, enabling financial institutions to make faster and more informed decisions. This can help financial institutions stay ahead of the competition and respond quickly to changing market conditions.

Data Analytics

AI can analyze large amounts of data to identify patterns and trends that would be difficult for humans to detect. This can help financial institutions make better-informed decisions and improve their products and services.

Customer Insights

AI can provide financial institutions with valuable insights into customer behavior and preferences. This can help them develop more personalized products and services that meet the unique needs of their customers.

Conclusion

AI has the potential to revolutionize the fintech industry, providing numerous benefits such as improved efficiency, enhanced customer service, and better decision-making. However, some challenges must be addressed, such as data privacy, bias and discrimination, and lack of transparency.

Financial institutions need to invest in skilled personnel and regulatory compliance to ensure the responsible use of AI. By leveraging the opportunities presented by AI, financial institutions can differentiate themselves in the marketplace, gain a competitive advantage, and provide better products and services to their customers.

Final thoughts!

As a software development company, Remotestate can play a crucial role in helping fintech companies build AI-powered software. Here are a few ways RemoteState can help:

Design and Development

Remotestate can help fintech companies design and develop AI-powered software that meets their specific needs. This includes identifying the features and functionality required, creating wireframes and mockups, and building the software from scratch.

Testing and Quality Assurance

Remotestate can provide testing and quality assurance services to ensure that the AI-powered software is robust, reliable, and free of bugs and errors.

Integration

Remotestate can help fintech companies integrate AI-powered software with their existing systems and processes, ensuring a seamless and hassle-free experience for end-users.

Maintenance and Support

Remotestate can provide ongoing maintenance and support for the AI-powered software, ensuring that it continues to function effectively and deliver the intended benefits to fintech companies and their customers.

Scalability

Remotestate can design the AI-powered software to be scalable, allowing fintech companies to add new features and functionality as needed and scale up or down based on demand.

In summary, Remotestate can help fintech companies build AI-powered software that meets their specific needs, is reliable and robust and integrates seamlessly with their existing systems and processes.

With Remotestate's expertise in software development and AI, fintech companies can leverage the power of AI to improve efficiency, enhance customer service, and make better-informed decisions.

FAQs

What is fintech?

Fintech refers to the use of technology to improve and automate financial services.

What is AI?

AI stands for Artificial Intelligence, which is the simulation of human intelligence in machines that are programmed to think and learn like humans.

How is AI used in fintech?

AI is used in fintech to automate manual processes, provide personalized services, and make better-informed decisions based on large amounts of data.

What are the benefits of AI in fintech?

The benefits of AI in fintech include improved efficiency, enhanced customer service, better decision-making, enhanced security, and cost savings.

What are the challenges of AI in fintech?

The challenges of AI in fintech include data privacy, bias, discrimination, lack of transparency, human oversight, technical complexity, regulatory compliance, reliance on data, competition, and ethical concerns.

Publication Date

2023-02-28

Category

Fintech

Author Name

Sajal Nehra