Introduction

The Internet of Things (IoT) is a network of physical devices, vehicles, buildings, and other items embedded with electronics, software, sensors, and network connectivity that enable these objects to collect and exchange data. This technology has the potential to revolutionize the way we live, work, and interact with each other. One of the areas where IoT can have a significant impact is financial inclusion.

The Internet of Things (IoT) is a network of physical devices, vehicles, buildings, and other items embedded with electronics, software, sensors, and network connectivity that enable these objects to collect and exchange data. This technology has the potential to revolutionize the way we live, work, and interact with each other. One of the areas where IoT can have a significant impact is financial inclusion.

In this blog, we will explore the role of IoT in extending financial services to the underserved.

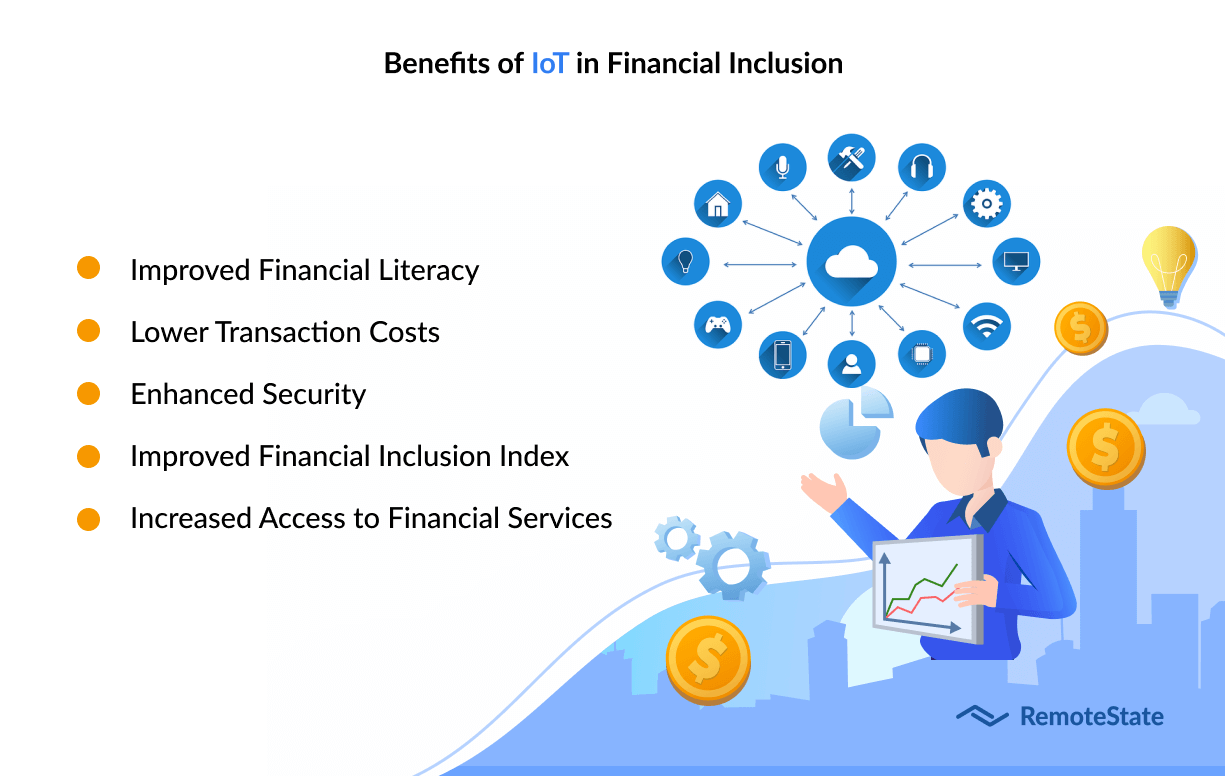

Benefits of IoT in Financial Inclusion

Increased Access to Financial Services

One of the primary benefits of IoT in financial inclusion is increased access to financial services. In many parts of the world, people still rely on cash transactions and do not have access to formal financial institutions. IoT can help bridge this gap by providing access to financial services through mobile devices, wearables, and other IoT-enabled devices. This can help individuals and businesses in underserved communities to receive financial services such as loans, insurance, and investments.

Improved Financial Literacy

Another benefit of IoT in financial inclusion is improved financial literacy. IoT-enabled devices can help people understand their financial situation better by providing real-time data on their spending and saving habits. This can help people make more informed decisions about their finances, leading to better financial management and planning.

Lower Transaction Costs

IoT can also help lower transaction costs for financial services. By enabling transactions to be conducted through mobile devices and other IoT-enabled devices, financial institutions can reduce the cost of maintaining physical branches and ATMs. This can result in lower transaction fees for consumers and businesses, making financial services more accessible and affordable for the underserved.

Enhanced Security

IoT can enhance the security of financial transactions. By using biometric authentication and other security features, financial institutions can reduce the risk of fraud and identity theft. This can help build trust in financial institutions and increase the adoption of digital financial services, making financial services safer and more reliable for the underserved.

Improved Financial Inclusion Index

IoT can also improve the financial inclusion index, which measures the level of access and usage of financial services. IoT-enabled devices can collect data on financial transactions and user behavior, which can be used to develop more accurate financial inclusion indices. This can help governments and financial institutions to better understand the needs of underserved communities and develop more targeted financial services.

Challenges of IoT in Financial Inclusion

Infrastructure Challenges

One of the biggest challenges of IoT in financial inclusion is infrastructure. Many underserved communities do not have access to reliable internet connectivity, which is essential for IoT-enabled devices to function properly. Additionally, the cost of IoT-enabled devices may be prohibitive for some individuals and communities, making it difficult for them to access financial services through these devices.

Data Privacy and Security

Another challenge of IoT in financial inclusion is data privacy and security. IoT-enabled devices collect a vast amount of personal data, and this data must be protected from unauthorized access and misuse. Financial institutions must implement robust security measures to protect their customers' data, ensuring that their privacy is respected.

Digital Divide

The digital divide refers to the gap between those who have access to technology and those who do not. The use of IoT in financial inclusion may widen this gap if underserved communities do not have access to IoT-enabled devices and reliable internet connectivity. Financial institutions must work with governments and other organizations to bridge this gap and ensure that everyone has access to financial services.

Technological Complexity

IoT-enabled devices can be complex, and many people may not understand how to use them. Financial institutions must provide education and training to underserved communities to ensure that they can effectively use IoT-enabled devices to access financial services. This can be a significant challenge, requiring financial institutions to invest in educational programs and partnerships with community organizations to ensure that everyone can benefit from IoT-enabled financial services.

Regulatory Challenges

IoT in financial inclusion may also face regulatory challenges. Governments and financial regulators may need to develop new regulations and policies to govern the use of IoT in financial services. This can be a complex process, requiring collaboration between multiple stakeholders to ensure that the needs of underserved communities are met.

Opportunities of IoT in Financial Inclusion

Innovation in Financial Services

IoT can drive innovation in financial services, creating new products and services that are tailored to the needs of underserved communities. By leveraging IoT-enabled devices, financial institutions can provide more personalized and accessible financial services, improving financial inclusion and increasing financial literacy.

New Business Models

IoT can also enable new business models for financial institutions. By reducing the cost of maintaining physical branches and ATMs, financial institutions can develop new revenue streams and business models. This can lead to increased competition and innovation in the financial services sector, benefiting underserved communities.

Partnerships and Collaboration

IoT in financial inclusion can also foster partnerships and collaboration between financial institutions, governments, and other organizations. By working together, these stakeholders can develop innovative solutions that address the challenges of financial inclusion and ensure that everyone has access to financial services.

Economic Growth

Financial inclusion is critical for economic growth and development. By extending financial services to the underserved, IoT can help stimulate economic growth and create new opportunities for individuals and businesses in underserved communities. This can lead to increased investment, job creation, and improved standards of living.

Sustainable Development

IoT in financial inclusion can also contribute to sustainable development. By providing access to financial services, individuals and communities can better manage their finances, invest in education and healthcare, and develop sustainable businesses. This can help reduce poverty, promote gender equality, and ensure that everyone has the opportunity to participate in the global economy.

Conclusion

IoT has the potential to extend financial services to the underserved, promoting financial inclusion, and fostering economic growth and sustainable development. However, the use of IoT in financial services also presents significant challenges, including infrastructure, data privacy, and security, the digital divide, technological complexity, and regulatory issues.

Financial institutions must work with governments, regulators, and other stakeholders to address these challenges and ensure that everyone has access to financial services. By leveraging the opportunities presented by IoT, financial institutions can develop innovative solutions that benefit everyone, promoting financial inclusion, economic growth, and sustainable development.

Remotestate's Role in Promoting Financial Inclusion Through IoT!

Remotestate can play a significant role in promoting financial inclusion through IoT. By developing innovative IoT-enabled solutions, Remotestate can help financial institutions to extend their services to underserved communities, improving financial literacy and reducing transaction costs.

Remotestate can also help address the infrastructure challenges of IoT in financial inclusion by developing scalable and robust IoT solutions that can work in low-resource environments. Additionally, Remotestate can assist in addressing data privacy and security concerns by implementing secure data transfer and storage mechanisms.

Furthermore, Remotestate can work with governments and financial institutions to develop policies and regulations that govern the use of IoT in financial services. By collaborating with stakeholders, Remotestate can help to ensure that the needs of underserved communities are met and that financial services are accessible to everyone.

In conclusion, Remotestate can contribute significantly to promoting financial inclusion through IoT by developing innovative solutions, addressing infrastructure challenges, ensuring data privacy and security, and collaborating with stakeholders. By leveraging its expertise in software development, Remotestate can help financial institutions to extend their services to underserved communities, promoting economic growth and sustainable development.

FAQs

What is financial inclusion?

Financial inclusion refers to the availability and access to formal financial services for all individuals and businesses, regardless of their income level or geographic location.

What are IoT-enabled devices?

IoT-enabled devices are physical devices that are embedded with electronics, software, sensors, and network connectivity that enable these objects to collect and exchange data.

How can IoT promote financial inclusion?

IoT can promote financial inclusion by providing increased access to financial services, improving financial literacy, reducing transaction costs, enhancing security, and improving the financial inclusion index.

What are the challenges of IoT in financial inclusion?

The challenges of IoT in financial inclusion include infrastructure challenges, data privacy and security, the digital divide, technological complexity, and regulatory issues.

What are the opportunities of IoT in financial inclusion?

The opportunities of IoT in financial inclusion include innovation in financial services, new business models, partnerships and collaboration, economic growth, and sustainable development.

Publication Date

2023-05-02

Category

Fintech

Author Name

Sajal Nehra