Introduction

Finance and software both have the ability to develop or destroy a firm, as is well known. \n Any significant software flaw has the potential to collapse the whole financial system.

Finance and software both have the ability to develop or destroy a firm, as is well known. Any significant software flaw has the potential to collapse the whole financial system. The use of cutting-edge technologies, including automated accounting, big data analytics, and AI-powered solutions, has accelerated recently. These technologies have assisted firms in reducing costs and improving customer experience. Big data has emerged, and it is now being mined to increase the effectiveness of financial operations. With the incorporation of artificial intelligence (AI), significant new insights can assist to enhance user experience, financial risk management, and credit choices. All of this has fueled the market expansion of services for developing financial software. The market for financial technology, which was estimated to be worth $110.57 billion in 2020, is expected to expand to $698.48 billion by 2030, with a CAGR of 20.3% between 2021 and 2030. The competitive environment is expanding along with the market, making it more challenging for businesses to select the best financial software solution. Let's begin with comprehending what financial software development is and the typical categories of Fintech products created for firms.

What exactly is financial software development?

Different FinTech Software Solutions

As the name indicates, financial software development, or Fintech, combines money and technology. Simply defined, numerous financial processes are developed to supply services effectively that improve financial management with the aid of technology or finance system software.

As the name indicates, financial software development, or Fintech, combines money and technology. Simply defined, numerous financial processes are developed to supply services effectively that improve financial management with the aid of technology or finance system software.

Popular Fintech Services Provided by a Software Development Company

Financial software supports a wide range of financial services, including payroll administration, invoicing, money transactions, and investment management. Following are a few examples of the business solutions that have emerged over time:

- Software for Billing and Payment No firm can function without billing and payment software, regardless of the industry. Every business is required to charge customers and pay vendors, accordingly. By automating procedures like invoicing, online payments, and other repetitive manual chores, the software makes processes quick while reducing human error. By producing several automatic reports that give management monitoring of the overall financial performance, the program also gives them more authority.

- Expense Management Software As its name implies, the expenditure management software keeps track of all business spending while giving you access to thorough expense reports. You can find cost-saving possibilities for many departments and personnel by automating money transfers. You can control current financial data and significant analytics with the aid of software. Additionally, automation enables the integration of various criteria for reviewing and approving charges before submission.

- Software for Financial Planning Using software to plan money streamlines the process overall. A financial software system based on data analytics aids in better planning of resource allocations leading to improved results. Financial planning software may assist in the evolution of sales tactics by giving vital information about how the company is operating.

- Software for investing The use of investment software can assist clients and organizational decision-makers in thoroughly reviewing key market data to make wise investment choices. AI-driven solutions and visual representations of financial data aid in data management and investment forecasting.

- Insurance Software The way insurance is made readily available with comprehensive knowledge has transformed thanks to insurance software. The convenience of comparison shopping, making payments online, and filing claims has caused a beneficial shift in the insurance sector.

- Using Blockchain for Solutions The majority of businesses prefer this fintech solution since it is future-proof. By decentralizing the data, blockchain technology offers a safe method of dealing while protecting the clients' vital financial information. Tokenization makes sales and buying transactions safe and secure.

Most significant trends in fintech software development

Of course, the pandemic has had a profound impact on society. However, the fintech sector has thrived and brought about beneficial developments. Let's examine the top trends that are clearly influencing fintech solutions for the future.

Of course, the pandemic has had a profound impact on society. However, the fintech sector has thrived and brought about beneficial developments. Let's examine the top trends that are clearly influencing fintech solutions for the future.

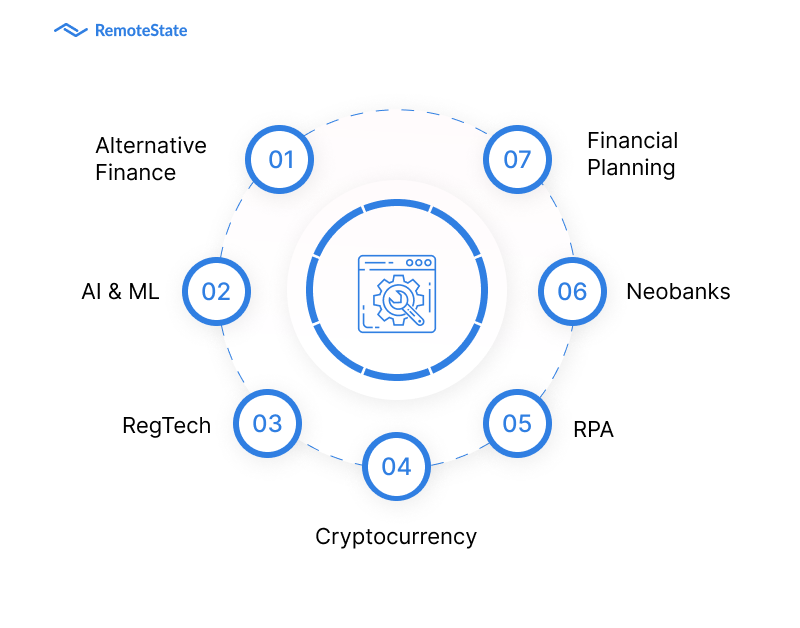

- Alternative Finance The broad definition of "Alternative Finance" includes several subcategories. "Financial channels and instruments that originate outside of the established financial system" (i.e., regulated banks and capital markets) is how it is defined. This approach gives SMEs the option to spend the funds any way they see fit while making it easier for them to acquire capital at a reduced rate of interest. Asset financing, property financing, crowdsourcing, stock financing, and supply chain financing are other forms of alternative financing. Artificial Intelligence & Machine Learning The fintech sector is very data-driven. With the use of AI and ML technologies, it is possible to analyze enormous amounts of accessible data to provide insightful and worthwhile results. Such data cannot be manually processed by humans. Risk reduction, process automation, customer service, and other crucial tasks have all benefited from the integration of AI technology with the financial services sector.

- RegTech RegTech is the fusion of technology and regulatory compliance. It provides data insights and reporting capabilities through the use of big data and machine learning technologies. Regulators can successfully address the risk of money laundering in financial services by increasing the bar for privacy legislation, security standards, and fraud detection.

- Cryptocurrency It has been more well-liked recently. The blockchain mechanism is used to preserve the ownership and transaction history of this decentralized currency. It provides the choice of auto trading and the simplicity of safe transactions. Due to its decentralized nature, it is not governed by governments, allowing for widespread acceptance and equal investment opportunities worldwide, regardless of race, color, or area.

- Robotic Process Automation (RPA) RPA in finance is a useful tool that enables automation, which reduces labor costs and time spent on tasks while increasing accuracy and productivity. Human resources may concentrate on projects with a high rate of return while outsourcing the boring, repetitive work to software robots.

- Neobanks Almost all banks have digitized their business processes and now give their clients the choice of mobile or web-based access. The experience has advanced thanks to digital-only banks. They are improving in terms of convenience, transparency, reduced wait times, and 24-hour availability, among other aspects. The banks save far more money on the infrastructure expenditures of the physical branch offices since all activities are fully automated with a digital interface and online.

- Neobrokers In the same way, Neobank is redefining the future of banking, Neobrokers is poised to transform trading and retail investing. Traditional assets are made more transparent and cost-effective through digitization and tokenization.

Choosing a Fintech Software Development Company: Important Considerations

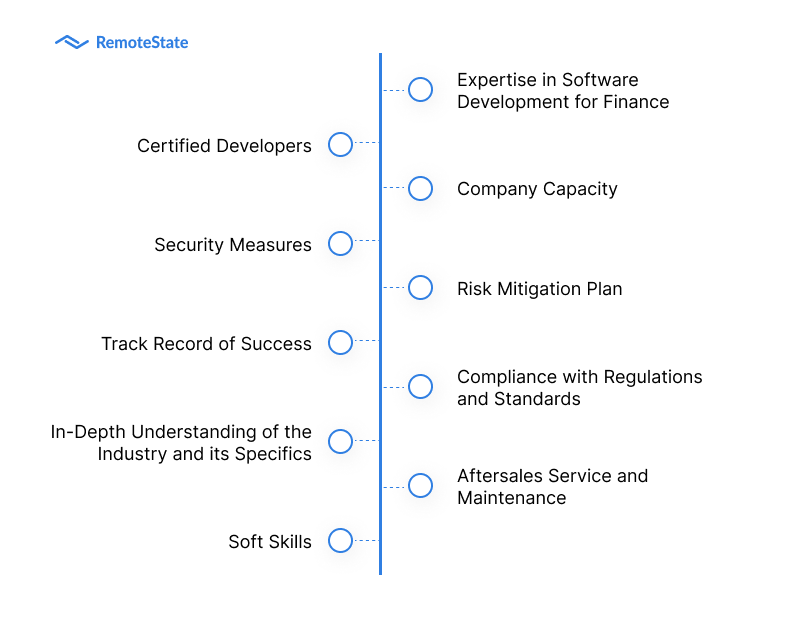

- Knowledge of financial software development The skill sets of the software development business you intend to work with are the most crucial factor to take into account. Making sure the business is up to date with cutting-edge technology, such as artificial intelligence, machine learning, big data, Java, data mining, etc., is crucial. The partner finance software firm should be knowledgeable about the present financial condition, futuristic in their approach, and analytical to make specific conclusions as the finance industry is developing. Make sure the partner has the right skill sets, and also watch out for a smooth interface with your current system. It is common knowledge that a financial development business you employ must be able to create software tailored to your industry.

- Certified Developers To guarantee the creation of bug-free software, the business you work with must employ skilled and experienced developers. To ensure the timely completion of the project without sacrificing on quality, it is equally crucial to make sure that the team's strength is appropriate and that a dedicated development team is aligned with the project. Don't forget to check if the team includes at least one fintech specialist.

- Company Capacity Success depends on having a strong, well-balanced team of committed individuals, but a lack of resources will result in late deliveries, software with problems, or software that is poorly structured. Make sure the outsourced partner has enough skilled personnel, such as programmers, testers, UI/UX designers, financial specialists, etc. You can evaluate the caliber of candidates by learning about their recruiting procedures and recruitment efforts.

- Security Steps When we discuss developing software for the financial and banking industries, security is the first thing that comes to mind. The best security safeguards for data and financial transactions must thus be in place before you employ a business to create financial software applications. The fundamental needs of every financial solution provider include things like firewalls and intrusion detection systems. The disaster recovery strategy is also essential in the event of any breaches of financial data.

- Risk Reduction Strategy A successful fintech software development firm must have a risk management tool and understand how to build a robust financial services company. a tool necessary for determining, evaluating, and assessing risk to make decisions to reduce potential losses. Understanding the gains that come with the risk and the return that can be obtained by controlling it while successfully establishing yourself in the market is crucial for risk mitigation. To prevent future disputes, be sure to consider all of the aforementioned factors when hiring a financial software development partner.

- A Successful History For your project, partnering with a reputable provider of financial technology solutions would be advantageous, particularly if you lack experience with financial software. It's important to know that you'll do things correctly the first time. You may get a good notion of their experience and success rates by reviewing the case studies of their prior initiatives. Additionally, being aware of their recruiting methods for financial software engineers can give you a good notion of their credibility.

- Regulation and standard observance The authorities have upped the bar for compliance and regulatory norms in response to an increase in incidents of money laundering and financial crime. It is crucial to confirm that the firm developing the financial software is familiar with the most recent compliance and regulatory requirements. Look for companies that have a history of creating legally sound financial solutions. The provider of financial software should be knowledgeable about techniques for protecting sensitive data and financial transactions, such as encryption and authentication procedures.

- Comprehensive Knowledge of the Market and Its Specifics This is an important thing to think about. To assist you in identifying possible areas for improvement, the banking software development business, for instance, should be current and able to give you information on the most recent developments in the banking industry. The organization should also have the expertise to create a system that is adaptable to changing conditions while taking your particular business demands into account.

- After-Sale Support and Upkeep The importance of the financial software company's approach being futuristic has been highlighted above, therefore they must give the maintenance service with the same level of care. Even the tiniest piece of software needs regular upkeep and fixes to remain functional. It is similarly crucial to confirm if the firm developing the financial app offers post-sale assistance for sustaining the created software.

- Soft Skills Success depends on effective communication. It still holds true when discussing the creation of financial software. The main components in making sure the project is on track are comprehending the requirements and effectively communicating the strategy and progress. Software engineers are no longer regarded as nerdy programmers with strong coding skills. To be the finest developer in today's and tomorrow's technology environment, one must be extremely analytical in addition to having strong time management, adaptability, inventive thinking, and problem-solving skills. It is essential to have a current understanding of both the financial and technological areas if you want the project to be successful.

What makes Remotestate the ideal candidate to create your fintech solution?

With a strong and established track record, Remotestate has collaborated with several businesses, including those in the banking, e-commerce, and hotel sectors. The team's expertise, experience, and analytical innovation have allowed us to effectively provide a variety of financial software development solutions. When you choose our financial software development services, you can be confident that you'll be dealing with a staff that is dependable, committed, and trustworthy. With several awards under our belt, we take satisfaction in being one of the fastest-growing software development firms. No matter what your Fintech business model is, Remotestate can be your co-developer of a successful fintech solution. Our staff is excited to help you turn your fintech company concept into a reality since we have a thorough understanding of trends, developments, and new business models. Reach out to us!

Publication Date

2022-12-02

Category

Fintech

Author Name

Sajal Nehra